Fast And Reliable Financial Solutions With Cash Apps

Quick financial solutions are essential in the modern world, particularly when unforeseen bills crop up. Having immediate access to cash can be crucial in situations involving unexpected purchases, urgent bills, or medical emergencies. Instant loans are a rapid solution to these financial demands. Instant lending apps like Cash App are growing more and more popular in Nigeria, where economic inclusion has emerged as a top priority. These apps provide quick, easy, and safe options for people in need.

What are cash apps?

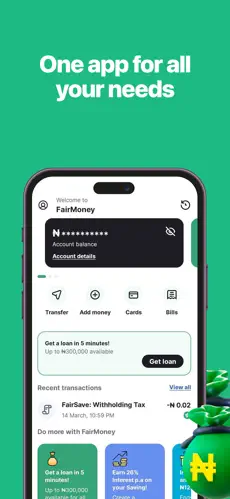

With the help of the well-known mobile payment app Cash App, users can send and get money instantaneously. It is renowned for being straightforward, inexpensive, and simple to use.

However, did you understand that the Cash App provides fast loan as well? Having instant access to funds without the lengthy wait times or intricate paperwork that come with standard bank loans might be an absolute lifeline when you’re in a tight spot.

How do instant loans work ?

Instant loan applications, such as Cash App, provide easy access to small, short-term loans. The procedure is easy to follow and frequently takes only a few minutes, which makes it perfect for those in need of quick financial assistance. You don’t have to go to a financial institution or lender in person to apply for a loan; you can do it right from your phone.

Many people in Nigeria lack access to conventional banking institutions, so these instant loan app in Nigeria offer a useful alternative. You may get money using a Cash App in a matter of seconds, and your banking profile—rather than your credit history—is used to determine approval.

Why are instant loans extraordinary?

- Ease and efficiency:

Instant loans get their name from how quickly they can be approved. Cash is one of many apps that promise approvals in a matter of minutes, so you can take care of urgent matters right away.

- Interfaces that are easy to use:

Simplicity is a priority in the design of contemporary loan applications. Anyone may use them, even those with little technical expertise, thanks to their simple navigation, concise processes, and clear directions.

- Very few requirements:

Perfect credit ratings and mountains of paperwork are things of the past. Usually, instant loan apps only need basic personal information, proof of income, and a government-issued ID.

- Adaptable loan choices:

These applications address a variety of financial needs, providing loans ranging from a few hundred dollars to larger sums, dependent on your eligibility.

Tips for using instant loan apps wisely:

- Borrow just what you need: Don’t take out more than you truly need; doing so may be alluring, but it might cause problems with repayment.

- Know the details: To be sure you understand precisely what you’re getting into, take a moment to review the monthly payment rates, fees, and payback conditions.

- Repay on schedule: To maintain a good credit rating and facilitate future borrowing, set an alert to pay back your debt on time.

Conclusion:

Instant lending apps like Cash App are a lifeline in a place like Nigeria where monetary needs might change at any time. They enable both individuals and small businesses to easily handle financial difficulties by providing quick loans with little effort.

You should look into an instant loan app right now if you’re looking for a quick, dependable, and easy approach to deal with urgent financial requirements. It only takes a few taps to achieve monetary liberty with these electronic possibilities.