How To Choose The Right Investment App For Your Portfolio

It’s easier than ever to invest today. Thanks to new technologies in fintech, anyone with a smartphone can start investing with only a few clicks. But it can be hard to choose a great investment app for your portfolio because there are so many to choose from. Making an informed choice is important whether you want to trade actively or increase your money passively.

Set your financial goals

Knowing what you want to get out of a share market investment app is the first step in choosing the ideal one. Do you want to invest to make money over the long term or only for a short time? A mutual fund app with SIP tracking and fund ratings can be better for you if you want to grow your money over time through mutual funds. But if you trade stocks a lot and like to purchase and sell them often, you need a strong trading app that gives you real-time data and technical indicators. It’s important to make sure that your aims match the characteristics of the platform, since each app is made for a particular type of investor.

Look for an interface that is easy to use.

A smooth experience can have a big impact on how often and confidently you invest. Even if you’re new to the stock market, the greatest investment software should be straightforward to use. The app should make it easy and quick to check your portfolio, make a trade, or look at how a fund has been doing. Many modern stock market apps provide easy-to-use dashboards, in-app tutorials, and simplified statistics that make it easy to make smart choices.

Put security and compliance first

You are giving the app your money and personal information, therefore security can’t be compromised. Make sure that the investment app is regulated by the right authorities, like SEBI in India. The platform takes security seriously if it has features like encrypted logins, biometric access, and two-factor authentication. Reputable trading applications are open about how they protect your data and regularly upgrade their systems to stay one step ahead of cyber threats.

Know How Much It Costs

There are many ways to pay for different apps. Some stock market apps let you trade for free, but you might have to pay for research reports or advice. Some people might have subscription plans that come with extra benefits. In the same way, certain mutual fund app may charge platform fees or advisory fees, even if most of them don’t charge commissions. If you plan to invest consistently or in substantial quantities, always read the fine print and know what you’re paying for.

Look at the range of things they offer.

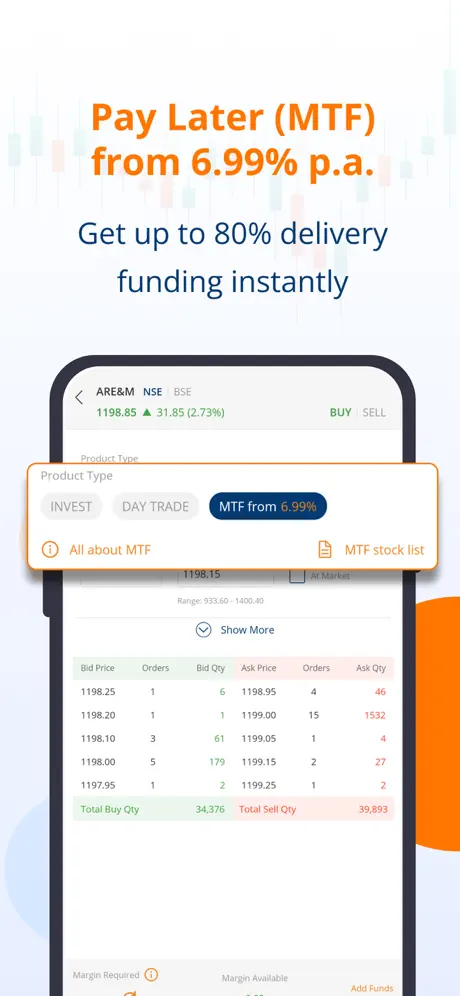

A good software for investing in the stock market lets you see a lot of different investment options. These could be equities, ETFs, mutual funds, IPOs, bonds, or even markets around the world. If you want a portfolio that is well-diversified, it’s best to choose an app that has both mutual fund and trading app features in one spot. You will have more freedom to make your investing plan if you have more possibilities.

Look at reviews and try out the platform.

Last but not least, don’t just trust marketing or suggestions from influencers. Take the time to read real reviews from people who have used the app to find out how reliable it is, how well it works, and how good the customer service is. To get a feel for how the platform operates, try out a demo or make a small investment. The greatest stock market apps are the ones that always give you value and establish trust by giving you a wonderful user experience.